Atal Pension Yojana 2025: Full Details, Benefits, Eligibility & How to Apply

What is Atal Pension Yojana?

Atal Pension Yojana (APY) is a government-backed pension scheme launched in 2015 by the Government of India under the Ministry of Finance. Designed primarily for workers in the unorganized sector, APY provides a guaranteed monthly pension after the age of 60, ensuring financial security in old age.

This scheme is administered by the Pension Fund Regulatory and Development Authority (PFRDA).

Key Highlights of Atal Pension Yojana 2025

- Assured monthly pension: ₹1,000 to ₹5,000 (based on contribution)

- Entry Age: 18 to 40 years

- Pension starts: From age 60

- Contribution: Varies based on age and chosen pension amount

- Govt. co-contribution: For eligible subscribers (only for early joiners till 2015)

Eligibility Criteria for Atal Pension Yojana

To enroll in APY, you must meet the following criteria:

- Indian citizen

- Aged between 18 and 40 years

- Must have a savings bank account (preferably Aadhaar-linked)

- Should not be a taxpayer (as per latest amendment from October 2022)

Benefits of Atal Pension Yojana

- Guaranteed monthly pension after 60 years

- Ideal for unorganized workers, daily wage earners, farmers, drivers, etc.

- Backed by Government of India – zero risk investment

- Contributions are eligible for income tax deduction under section 80CCD(1)

- Nominee facility in case of subscriber’s death

- Online account tracking via bank or PFRDA portal

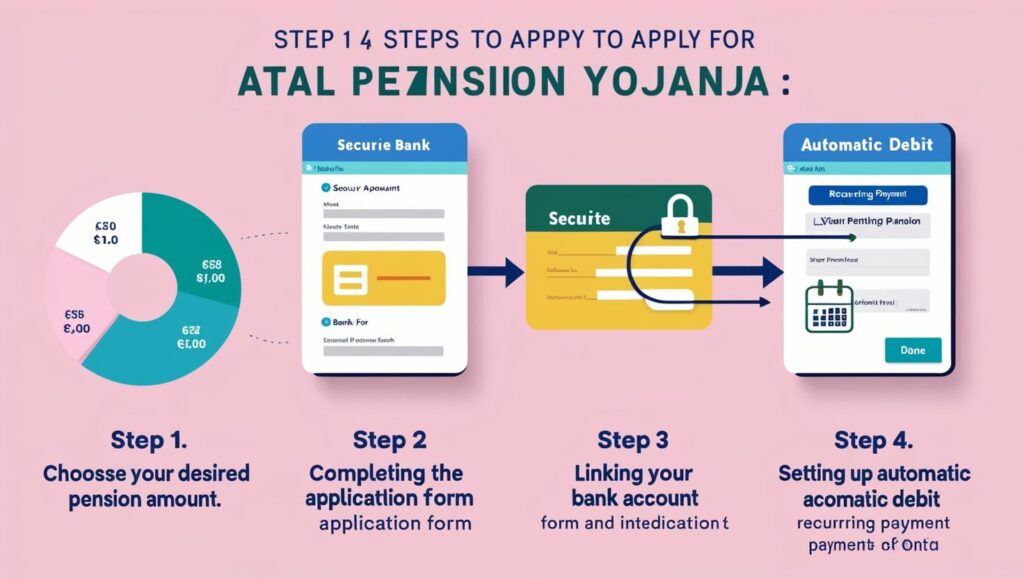

How to Apply for Atal Pension Yojana

You can apply for APY through both online and offline modes.

Offline Method:

- Visit your bank branch

- Fill out the Atal Pension Yojana registration form

- Provide Aadhaar and mobile number

- Submit consent for auto-debit of monthly contributions

Online Method (Available in major banks):

- Login to internet banking

- Look for Social Security Schemes or APY

- Fill and submit the registration digitally

Monthly Contribution Chart

| Entry Age | ₹1,000/month | ₹2,000/month | ₹3,000/month | ₹4,000/month | ₹5,000/month |

| 18 | ₹42 | ₹84 | ₹126 | ₹168 | ₹210 |

| 25 | ₹76 | ₹151 | ₹226 | ₹301 | ₹376 |

| 30 | ₹116 | ₹231 | ₹347 | ₹462 | ₹577 |

| 35 | ₹181 | ₹362 | ₹543 | ₹724 | ₹902 |

| 40 | ₹291 | ₹582 | ₹873 | ₹1164 | ₹1454 |

Contributions are auto-debited monthly from your savings bank account.

Important Update for 2025

- From 1 October 2022 onwards, taxpayers are not eligible to join APY.

- Individuals who joined earlier can continue their account.

- Always keep your mobile number updated with the bank to get alerts.

FAQs About Atal Pension Yojana

Q1. Can I exit APY before 60 years of age?

Yes, but only in case of terminal illness or death. Early exit is otherwise discouraged.

Q2. Can I change my pension amount later?

Yes, you can upgrade or downgrade your pension slab once per year.

Q3. What happens if I miss contributions?

You may face:

Penalty of ₹1 to ₹10/month

Account freeze after 6 months

Account closure after 24 months of non-payment

Q4. Can I have both APY and NPS?

Yes, APY is for low-income unorganized workers, while NPS is open to all.

Internal Links

How to Get ₹5 Lakh Free Health Insurance under Ayushman Bharat Yojana 2025

How to Apply for PM Awas Yojana 2025 Government Scheme

Final Thoughts

Atal Pension Yojana is a thoughtful initiative for India’s unorganized sector workforce. With just a small monthly contribution, individuals can secure their retirement and live with dignity post-60. If you’re eligible and haven’t joined yet, this is the right time to act.

Visit your bank or log in to your online banking portal and register today!

Disclaimer

Disclaimer: The information provided in this article is for educational purposes only. Readers are advised to verify scheme details and guidelines from the official PFRDA website or bank branches before taking any action.

1 comment